MoneyMate

Nurturing Financial Awareness in Children

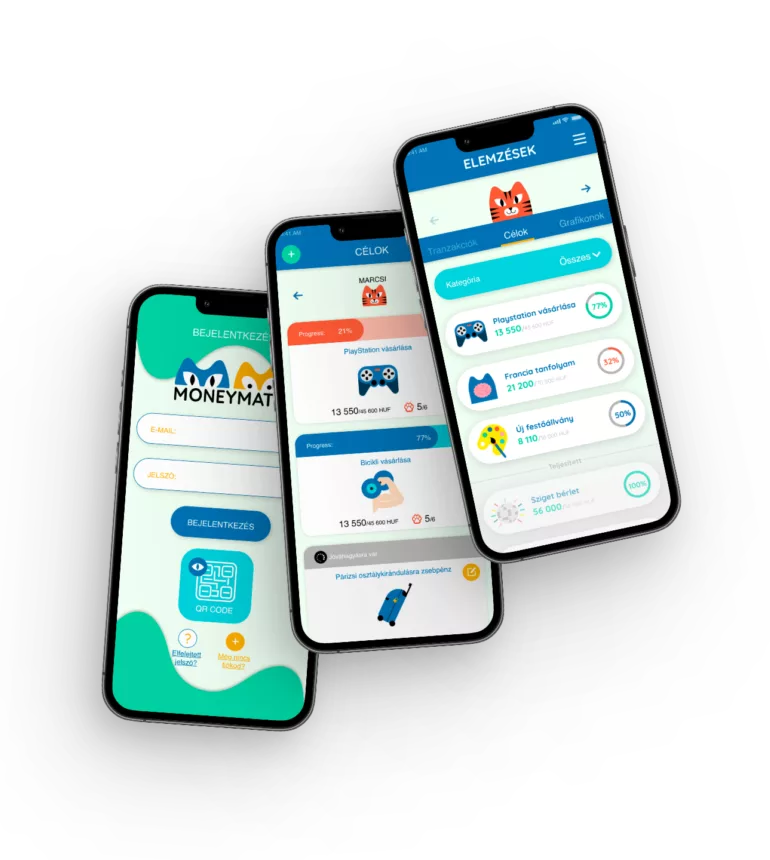

Project Overview: MoneyMate is a revolutionary application designed to serve as a motivational tool, fostering the financial development of children. This innovative platform empowers kids to become financially conscious individuals by making saving and goal-setting an engaging and rewarding experience.

Challenges: The challenge lay in creating an application that effectively instilled financial awareness in children while ensuring it was easy for parents to manage and monitor.

Solutions:

1. Goal Creation: MoneyMate simplifies the process by allowing users to set specific financial goals, such as saving for an Xbox purchase (e.g., 20,000 Ft).

2. Activity-Based Rewards: Users can create activities and assign monetary rewards to them. For instance, reading one book per week could earn a child 2,000 Ft.

3. Goal Achievement: The app provides a timeline for goal achievement, making it possible for children to reach their financial milestones in as little as 10 weeks. Parents approve completed activities, encouraging a sense of accomplishment.

4. Freemium Model: MoneyMate employs a freemium business model, offering a free trial of the application's basic features. Users can also opt for the premium package, unlocking unlimited features to enrich their digital savings experience.

User Experience:

MoneyMate comprises two distinct interfaces:

- Parent Interface: Parents have access to a comprehensive dashboard where they can set financial goals, create activities, and monitor their child's progress. This interface ensures they are actively involved in their child's financial journey.

- Child Interface: Designed to be user-friendly and limited in functionality, this interface allows children to view their goals, activities, and progress, fostering a sense of responsibility and independence.

Results:

MoneyMate has garnered significant attention for its unique approach to financial education:

- Empowering Financial Literacy: The application has empowered children to take control of their financial future, teaching them essential money management skills.

- Parental Engagement: Parents appreciate the ability to actively participate in their child's financial education, reinforcing valuable lessons at home.

- Flexible Business Model: The freemium model provides accessibility to all users, ensuring that financial literacy is accessible to as many families as possible.